UPDATE (June 13th, 2022): Celsius Network has paused all withdrawls indefinitely after the weekend. There have been rumors that it has become insolvent. They are still advertising their interest rates, but I would problably stay away from it until it everything clears. There is a real risk that people with funds in the Celsius platform will lose their money.

The world of crypto is full of opportunities to make some “free” extra money. However, you still need to invest some of your money to earn that “free” money. In this post, I will show you some of the best sign-up bonuses to increase the return on your investment.

There are different crypto exchanges and even some traditional stock brokerages that will give you a nice sign-up bonus with minor investments. I cannot list all of them, but I am sharing the ones I have tried.

Table of Contents

- Intro

- Disclaimers

- Abridged Version

- List of Exchanges

- Possible Strategies

- Some Tax Considerations (not legal advise)

- Using a Hardware Wallet or Keeping Coins On Exchange

How To Earn Different Sign-Up Bonuses

Keep in mind that in general, you will have to put some money into these services to earn a sign-up bonus. Sometimes, it is simply a matter of making an initial deposit.

Other times, you will need to make a transaction inside the platform in order to qualify.

In this post, I have compiled a list of some of the best sign-up bonuses I could find. I am listing the platforms that I personally use or have used. In case I list one that I have not tried yet, I will explicitly say so.

For your convenience, I am also detailing a possible strategy to get the most out of these deals and how much money you may need.

Disclaimers

I think the information in this post is very useful if you want to make the most out of your money. However, please remember that this is not financial advice and I am not a financial advisor, just a random person on the internet.

Do your due diligence in assessing any platforms or coins listed here, or any strategy I mention. At the end of the day, it is your money!

I also need to mention that most, if not all of the links for the sites are referral links. That means that I may also be compensated if you use them, but at no extra cost to you.

Sign-Up Links

I highly recommend that you read through the whole post to be better informed. Regardless, whether you do not have time, or you finished the post and want to be able to find the links in one place, here they are (make sure you do your due diligence, as always) as well as a little TL;DR:

- Celsius: $50 in Bitcoin after Transfering $400 or more in crypto (12.5% return on investment)

- Voyager: $25 in Bitcoin after a $100 transaction or more (25% return on investment)

- Coinbase: $10 in Bitcoin after a $100 transaction or more (10% return on investment)

- BlockFi: $10 in Bitcoin after a $100 transaction or more (10% return on investment)

- Gemini: $10 in Bitcoin after a $100 transaction or more (10% return on investment)

And other links that are useful for crypto investors:

- Hardware wallet to keep your coins offline (Ledger Nano X)

- Great software to help you with keeping track of your coins and filing taxes (Cointracker.io)

If you get all the promotional sign-up bonuses listed here, you could get around $105. The amount of money you put in can be as high as $800 or as low as $400 (give or take a few dollars).

Which Exchanges Have The Best Sign-Up Bonuses?

Here are the exchanges I have tried, plus the amount you can make for each one, ordered more or less from highest earnings to lowest:

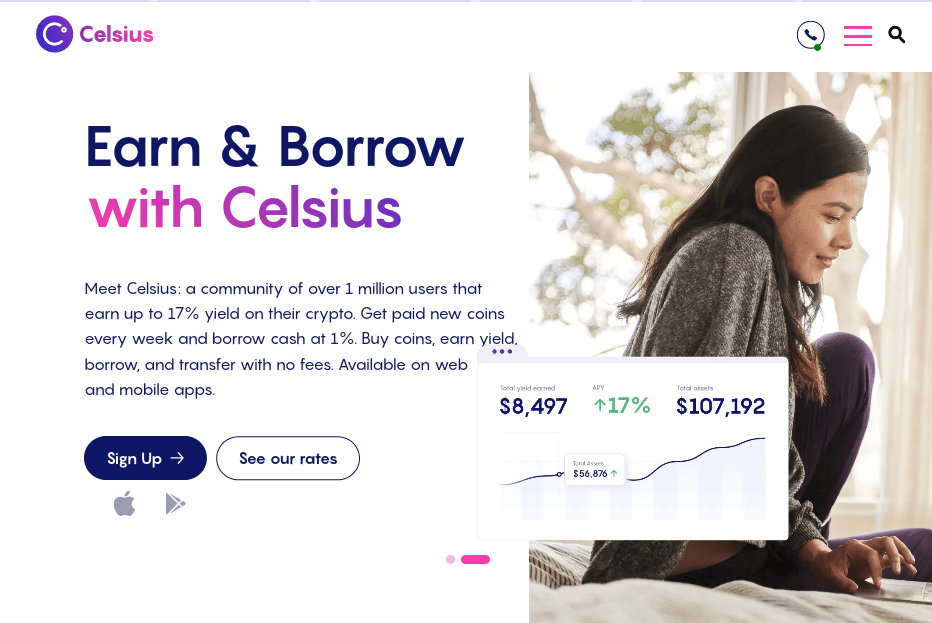

1. Celsius ($50 or more)

Let’s start with Celsius. They offer a decent sign-up bonus of $50 (paid in Bitcoin) when you sign up and transfer $400 or more of crypto into your Celsius wallet. Even though you might get away with making 2 transfers that add up to $400 to meet the requirements, the safest option is to make one lump transaction in that amount.

Moreover, Celsius has several promo codes that you can activate when you sign up. You are required to maintain your balance on the Celsius platform for 30 days without moving it. Some promo codes require an even longer time.

Each promo code will require you to make an additional transfer. This means you cannot lock several promos with a single deposit, anymore (you used to be able to do that, but apparently they have restricted this since).

In case you are planning to use additional promo codes, it is recommended to add the smallest first. Furthermore, complete each promo requirement in the order you entered them.

I really like Celsius, not only for the sign-up bonus but also because they offer high-interest rates on your crypto if you decide to keep it in there.

In fact, while you wait out the locked period of 30 days, your crypto will be earning interest. Right now, Celsius is paying about 6.25% interest on Bitcoin for US customers (it’s slightly higher for non-US customers), but some cryptos are paying much higher rates.

However, always double-check because those rates are variable.

Interest is paid out weekly so your coins can compound faster. Just keep in mind that there are always risks with crypto-lending platforms.

At the end of this post, I am also including some options if you prefer to store your crypto yourself instead of keeping it online.

2. Voyager ($25 Bonus)

Next on the list is Voyager, one of my favorite platforms for storing crypto because of its very competitive interest rates. I still prefer Celsius because of their weekly payouts in comparison with Voyager’s monthly payout.

Additionally, Voyager has a minimum monthly average balance requirement for each coin for it to start earning interest.

Nonetheless, I still think Voyager is a great option. Right now they are offering a $25 sign-up bonus in Bitcoin when you trade your first $100. This is the highest bonus in terms of return on investment (25%) among the options listed here.

The best part is that you can buy $100 of a stablecoin like USDC and it will eventually start earning you 9% interest at current rates (always double-check this for yourself).

By keeping my coins on different exchanges I protect myself a little more from hacks. Keeping your coins online always carries risks, but if you spread them around, it is less likely that a single hack to one platform will wipe you out completely.

Interestingly, Voyager is a publicly-traded company and registered in the Canadian stock market.

3. Coinbase ($10 Bonus)

Next on the list is Coinbase, another publicly traded company, although this time on the US stock market.

Right now, Coinbase is offering a $10 Bitcoin bonus for signing up and making a $100 or higher transaction. Just as with Voyager, you can purchase a stablecoin like USDC for $100 and that should qualify you to earn the bonus.

In the screenshot above you can see that the advertised rate is $5. However, it seems that you get $10 by using a referral link like the one I’m sharing here.

Coinbase is a great platform for beginners. However, they have a flat-fee rate based on tiers. For small transactions, it can be costly. If you want to trade crypto more seriously, I would suggest using Coinbase Pro.

You use the same account for Coinbase and Coinbase Pro and can transfer your assets for free and instantaneously from one to the other, but that is for another article.

4. BlockFi ($10)

Moving on, BlockFi is another crypto lending platform where you can earn interest on your crypto deposited there. The current sign-up bonus is $10 in Bitcoin after a $100 transaction.

If you keep your coins there, you can expect a monthly payout. There is no minimum balance to start earning, but there is a tiered interest system. That just means that you earn the advertised interest up to a certain amount, and the rest earns a lower rate.

That will probably not be an issue for the majority of people, since the first cap for most coins is decently high.

5. Gemini ($10)

The last platform on this list is Gemini. They are an exchange and also offer crypto-lending solutions. Right now, there is a sign-up bonus of $10 in Bitcoin with your first $100 transaction.

I have only used Gemini very sparingly so I do not have a lot to say. Nonetheless, it is a trusted exchange and my limited experience has been good. They will also allow you to earn interest on the crypto you decide to keep there.

How to Maximize Your Sign-Ups

If you have the money for it, the easiest and fastest path to get all the bonuses is to simply open an account with each platform and complete each sign-up bonus requirement.

However, this approach will require at least $800, and let’s be honest, not a lot of us have that much lying around just for crypto.

Another approach would be to purchase crypto in some of the other sites, like Voyager, Coinbase, etc, and then transfer it to Celsius to meet the promo requirements.

It would look something like this:

The Least-Investment Option – More Headache

- Sign-up for Voyager, Coinbase, BlockFi and Gemini and buy $100 of BTC in each (or any coin)

- Once you are able, transfer all BTC from the other accounts to combine them into Coinbase (some transaction fees will apply)

- Move BTC from Coinbase to Coinbase Pro (for free)

- Sign-up for a Celsius account and apply any additional promo codes

- Transfer your BTC from Coinbase Pro to Celsius (make sure it is worth at least $400, but it might be better to aim a little higher)

As you can see, this approach potentially cuts down the required investment by half.

On the other hand, it might complicate your life having to make several transactions. Additionally, each platform will have a lockdown period where you cannot withdraw your coins, potentially slowing down the whole process.

I used BTC in the example above, but it is not exactly the cheapest cryptocurrency for moving money around.

In the past, I have used XLM when I needed to make a cheap and fast transaction, so you could consider it as well. However, you need to consider also which coin you would like to hold in Celsius.

A Few More Things To Consider

If you intend to hold BTC but use XLM to consolidate them on a single exchange, then you will need to sell your XLM for BTC before you send it over to Celsius.

Besides the extra transaction costs, all these steps might create a tax headache for you later down the road (each time you exchange one crypto for another, it is a taxable event).

You must also keep in mind that there is always the risk that the coin you choose will drop in value significantly in between transactions.

Therefore, before you make the final move to Celsius, you might need to invest a little more to be above the minimum $400 (it is always a good idea to leave a healthy margin of error in case of price drops).

I personally wanted to keep BTC on Celsius and already had the required amount in one of my wallets, so I just needed to make one transaction.

Another Option Is To Buy USDC

If you are concerned about price fluctuations, you can always buy stablecoins, such as USDC, USDT, GUSD, etc. I prefer to avoid USDT because of the ongoing controversy surrounding its reserves.

In general, I personally use USDC, but that is up to each individual investor.

The advantage of stablecoins is that they are pegged to a real dollar, and so their price should remain stable, hence the name.

The reason why I would not choose them for transfers at this point is that most of them, if not all, exist as tokens on the Ethereum network. That means very high transaction fees, even if the amount you are sending is small.

What If You Don’t Have That Much Money Sitting Around?

If I only had $100, I would probably just sign-up with Voyager and buy USDC to start earning some interest. This account provides the highest ROI from the platforms I listed in this post.

You could then save up some money from time to time and get the other sign-up bonuses one by one as you are able to.

Celsius is nice because of their weekly payouts and the fact that you can start earning interest on most coins no matter the amount. In contrast, Voyager, for example, requires a minimum BTC balance of 0.01 to earn interest on Bitcoin. That is almost $500 at current prices. So, if you are able, maybe Celsius could be a good account to open.

Some Tax Considerations

Let me prelude this section by reminding you that I am not a financial, tax, life, or any kind of advisor. You must do your own research about your tax situation. Here are just some considerations that might apply to people in the US.

I have not checked the new updated tax laws, but it seems that now even transactions between wallets need to be reported. For example, if you transfer your BTC from one exchange to your own offline wallet, you may need to prove to the IRS that this was not a sale but simply a transfer.

Moreover, sign-up bonuses will typically be taxed as regular income at the time you received them. If you later sell the coins you got as a bonus, you will also be taxed for capital gains on that amount.

Lastly, you also need to pay taxes on the interest you collect from your crypto.

Setup a System for Keeping Track of Your Crypto Transactions

The best tip I could give you to make your life simpler is to keep track of every transaction and bonus you receive.

Do this across all the exchanges and wallets you use.

The way I approach this issue is by adding each new transaction to a spreadsheet on Google Sheets.

I write the date of transaction, the amount, the coin symbol, and if it is a purchase, I add the cost basis.

If I sell something, I add the proceeds as well.

If this level of detailed tracking sounds very daunting, I would suggest a tool like cointracker.io.

I actually use both methods myself, but cointracker is probably sufficient and less time-consuming.

Cointracker will keep updated records of all your transactions across wallets for free. Then, when tax season comes, it will calculate everything you need.

This is a paid service if you have more than 25 transactions in a year.

However, even if you do not use the paid tax service, just keeping track of your crypto and all transactions might be a huge time saver.

Where To Keep Your Crypto After Purchase

Once you buy your crypto there is the question of where to store it. If you decide to keep in on the exchange or platform where you bought it, then there is nothing else to do.

Keeping it on the exchange makes your funds more vulnerable to hacks. However, you can usually benefit from interest from crypto lending sites. You should weigh the benefits of extra income against the risks.

In case you prefer to keep control of your assets yourself, hardware wallets are typically the best option. You can be in control of your coins and do not need to worry about passwords too much.

The hardware wallet I use is Ledger Nano S. It is very simple but can only hold 3 different coin wallets at a time. As a result, if I need to deal with several cryptos, it is a bit of a hassle to keep uninstalling and installing the wallets again. For this reason, I would suggest anyone new go directly for the Ledger Nano X.

The Nano X improved on the Nano S on a few points. First, it has more internal memory, so it can hold many different cryptos at the same time. Second, the Ledger Nano X has Bluetooth included, so you can connect wirelessly to your computer or phone.

There are also risks with self-managing your crypto assets. For one, if you forget your seed (a list of mnemonic words) and also lose your hardware wallet, your funds might get lost permanently.

Subscribe to the Newsletter

If you are interested in hearing more about topics like this (and also about Python tips and tricks) then subscribe to the newsletter below. I plan to send out emails every one or two weeks. If this changes, I will let everyone know.