With all the volatility going on in the markets these days, I thought it would be a good idea to analyze my portfolio to determine which have been my best stock picks so far. To keep it short, I’m only focusing on my top 5 investments based on returns.

Disclaimers

Don’t take anything I write here as investment advice. This post is for entertainment purposes only. I’m not any kind of advisor. Additionally, by investing in the stock market you can lose everything because you are never guaranteed a return.

Best Performers

Keep in mind that I took this data on the morning of February 24th, 2022, before the market opened. You will notice that the best-performing stocks from this list are in the technology sector. That should not be a surprise given the astounding rise in tech companies in the past few years.

It is also important to recognize that those same tech companies are at risk right now. With the rise in interest rates and other fears in the market, companies whose valuations rely on future earnings are taking a bigger hit. Nonetheless, even with all the current volatility and market drops, most of my stocks are in the green.

I owe that to the fact that I have invested consistently for a few years and never sold. Most of the stocks on this list were added to my portfolio around June-August 2017.

I guess the point that I’m trying to make here is that time in the market is better than timing the market, as is usually repeated. There is a lot of truth to that saying. I can see how someone who just started investing could feel very scared with recent market drops. With that said, I’m an expert with a lot of experience either. My portfolio is not even five years old yet. That means that I have not experienced a recession so far. There were some concerning moments in 2018 and 2020, but I did not allow fear to mess with my investment strategy.

AMD (+473%)

My best stock pick is, by far, AMD (Advanced Micro Devices). I made my first purchase of AMD on July 31, 2017, at $13.50 per share. At the time, I thought that it had a chance to come around. My experience with their products had not been great, but I kept hearing how they were improving. In the end, I’m glad I took the chance to invest in it.

Currently, my return on investment is over 473%. My initial purchase must be close to an 800% return but I have been dollar-cost averaging, so my average purchase price is higher now. Keep in mind that this return is already factoring in the 27% drop in the past 3 months.

Despite being currently my best performer, there were times when I was in the red on this investment. If I remember correctly, shortly after my initial purchase, AMD fell to $9 or something like that. That was a huge drop for me because I was completely new to the market. After that initial shock, I remember I was about to double my shares at that price but then decided to put the money somewhere else. Sometimes I still kick myself for that a little bit.

NVDA (+367%)

I decided to invest in Nvidia because I know the brand and I believe they make good products. Also, I was expecting the use of GPUs for machine learning would continue to grow in the future and Nvidia is a top player in that space.

My initial purchase was on August 8, 2017, at $169 per share. After adjusting for splits, my initial purchase price would be $42.25 per share. My total return on investment is over 367%, even after taking into account the 30% drop in the last 3 months.

AAPL (+230%)

I was hesitant to invest in AAPL because I had never used an Apple product. However, after some analysis, it became clear that the stock was a cash machine. One thing that I liked a lot is that AAPL had started paying a dividend not too long ago. Since the dividend growth rate was high and their payout ratio low, I thought it was a good opportunity.

My initial purchase was on August 10, 2017, at $158.50 per share. AAPL performed a stock split in 2021, so adjusting for that, my initial purchase price is $39.6 per share. As always, my only regret is not focusing more on growth stocks like this instead of dividend stocks only. But I guess hindsight is 20/20.

In terms of recent volatility, this stock has remained relatively strong. Even though it fell over 10% just in the last week, for the past 3 months it’s only down about 3%.

MU (+105%)

I invested in MU because of an article on the Motley Fool’s website. I agreed with the conclusion that the future looked bright for this company, so I bought some shares.

My first purchase was on August 21, 2017, at $29.50 per share. For a while (2018-2020) the price mainly remained within a defined horizontal area. I’m not sure what caused the stock price to suddenly jump at the end of 2020, but it was a welcome change.

ABBV (+71%)

What attracted me to ABBV initially was its dividend growth. They seemed to be committed to raising the dividend every year, and I wanted to grow my passive income.

I made my first investment in ABBV on June 27, 2017, at $72.55 per share. I made the mistake of buying some more when the price reached $120 shortly after. Since then, it took almost 3.5 years to get back to its all-time high. I wasn’t complaining, though. This gave me an opportunity to accumulate more shares at low prices.

Notable Mentions

I wanted to also mention my next top 4 stock picks. These ones did not do as well as the other ones, but it is worth pointing out that I started investing in them sometimes almost a year after. Again, time in the market beats timing the market.

The notable mentions are:

- PEP (PepsiCo; up 60%)

- SBUX (Starbucks; up 48%)

- PG (Procter & Gamble; up 47%

- PSA (Public Storage; up 46%)

How Do They Compare With the SPY?

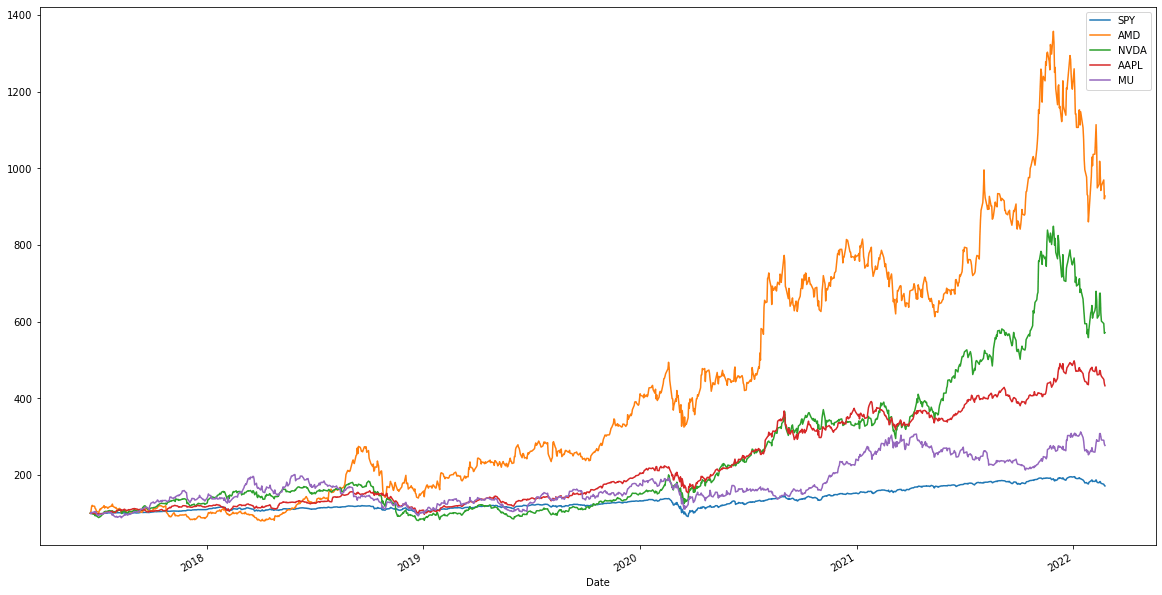

I thought it would be interesting to see how my investments compare to the SPY. For that, I wrote some simple Python code that you can check out in my Github repository.

For the comparison, I’m assuming that I made an investment of $100 in each company on June 17, 2017. I chose that date because it’s the day I started my investment journey.

The comparison won’t be exact because I did not invest in all those companies at the same time. Most of the notable mentions were purchased well into 2018. Maybe later I will make a better comparison with actual purchase dates taken into account.

First Graph: SPY vs All Top 9 Stocks

Here we can see how my 5 best stock picks completely dwarf the returns of the SPY over that period. On the other hand, my next top 5 performed significantly worse than the index. The next charts will show each group separately.

Second Graph: SPY vs Top 5 Stocks

Again, here we see clearly how the SPY totally lagged behind many tech stocks since the middle of 2017. In this case, I feel the data is very close to how it played out in my portfolio because the simulated purchase date is very close to the real one.

Third Graph: SPY vs Lower Top 4 Stocks

Here the roles are reversed. The data shows that even though PEP, SBUX, PG, and PSA are among my best performers, I would have been better off simply investing in SPY in this simulation. Of course, the data here is not taking into account the fact that I invested in many of these stocks in 2018, or even 2020 (PSA, for instance). It is likely that in many cases, my returns are still greater on individual stocks.

Conclusion

For me, investing is a long-term journey and I feel that my examples here are evidence of that. There were occasions when I was losing money even on my best stock picks, such as AMD. However, by continuing to invest regularly and ignoring market noise, today I enjoy a nice profit (on paper).

In a previous post, I mentioned that my goal was to focus more on growth stocks in the future. The past month and a half have only made that focus clearer. It seems that tech stocks are going on sale, or about to, at least relative to their normal valuations. The result is that I can buy more shares at cheaper and cheaper prices.

I will follow up this post with a list of my worst-performing stocks to have a fair view of my investing journey.

Which have been your best stock picks? Share it in the comments. I would also like to hear about your opinion on the current market situation.